Property Launches & Investments

This is some blog description about this site

Six years of low interest rates in search of some growth

- Font size: Larger Smaller

- Hits: 1611

- 0 Comments

- Subscribe to this entry

- Bookmark

Central banks have cushioned the developed world’s economy in a difficult period. They have yet to boost growth as they had hoped.

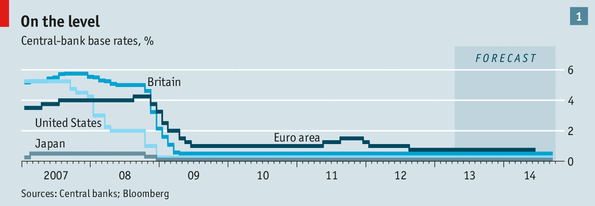

NEVER in recent economic history have interest rates been so low for so many for so long. It is a safe bet that central banks in America, Britain, the euro zone, Japan and Switzerland will not be increasing short-term interest rates this year. Haruhiko Kuroda began his tenure at the Bank of Japan with a dramatic easing of policy on April 4th. Mark Carney, the new boss at the Bank of England, has licence to ease, too. It would be hardly surprising if rates stayed at the low levels of the past four years throughout 2014 (see chart 1). When rates were first cut to their current levels in 2008-2009, it looked like a temporary expedient; now it looks like normality.

Businesses and investors are still adjusting to this new world. Big companies have taken the opportunity to borrow in the bond markets, locking in cheap financing for years to come. But the cheap money has not led to the growth-igniting investment spree the monetary policy was designed to encourage. There are some signs of an economic revival in America. But the prospects elsewhere are bleak; Europe’s purchasing managers’ index for March showed a further fall in manufacturing activity while unemployment reached 12%, the highest since euro-area data were first compiled in 1995. In such a world monetary policies are likely to stay loose—even though, in their desperate search for yield, investors are rediscovering a worrying appetite for the kind of structured debt products that many thought had disappeared for good after 2008.

A breath of air

Low rates have some clear positive economic effects. The Federal Reserve has been buying mortgage-backed bonds as a way of forcing down yields and thus reducing the cost of home ownership. On March 29th the average rate on a 30-year mortgage was just 3.57%, not far above the 3.31% reached in November, the lowest since data started to be compiled in 1971.

A lower mortgage rate puts money into homeowners’ pockets when they refinance their loans (mortgage origination jumped by 39% to $1.75 trillion last year). It also encourages people to move. Existing-home sales were 4.66m last year, according to the National Association of Realtors, below the 5.04m recorded in 2007 but still 9% ahead of the total in 2011.

In addition, 366,000 new American homes were bought last year, the first annual sales increase since 2005. Higher sales prompted homebuilders to get busy: in February, permits for future construction reached an annualised 946,000, the most since June 2008. More construction means more jobs for builders and more sales for timber yards and brick factories.

Houses are not the only things people spend more on when borrowing is cheaper. According to Equifax, Americans took out 19.9m car loans worth $388 billion in the first 11 months of 2012; both figures were six-year highs. Total American car sales rose by 13.4% to 14.8m last year, the highest total since 2007. The number of people employed making cars remains well below the 1.1m of 2005, but it has risen from the 624,700 of 2009 to 788,100. The number of people employed processing credit transactions is the highest for almost four years.

Higher house prices have made people feel wealthier and more willing to spend. Low interest rates have also boosted share prices, with both the Dow Jones Industrial Average and the S&P 500 reaching all-time highs in March. To see this as a return of animal spirits, though, may be premature; March’s data showed a sharp fall in American consumer confidence.

And untempered enthusiasms could be a danger. History offers plenty of prolonged periods of low interest rates that encouraged speculative booms, particularly in property. In Thailand in the mid-1990s a property boom fuelled by cheap dollar loans ended in devaluation and disaster. In Spain and Ireland in the early 2000s cheap euro-denominated loans resulted in another property bubble.

Excessively low rates help to create bubbles because they allow investors to ignore the cost of financing and concentrate on the capital gains if their strategy works; they let people forget risk and focus too much on reward. Encouraging the revival of a property market in the doldrums risks creating a boom that will simply lead to another bust. Bubbles may not have emerged yet. But if they do, the eventual task of returning to normal monetary policy will be made even more complicated.

This time round, the appetite for high returns that low rates are meant to bring about has been slow to arrive. Investors were so shell-shocked by the impact of the banking collapse of 2008 that they stuck to safe assets. But several years on, investors are getting more restless.

The key point is not that nominal interest rates are low. It is that, outside Japan, real (after-inflation) interest rates are negative—money stashed in a bank buys less when it comes out than it could when it went in. And not only are government-bond yields low: given the high debt-to-GDP ratios of many nations, they aren’t even all that safe. In the joke of Jim Grant, who writes a financial newsletter, instead of offering risk-free return they offer return-free risk.

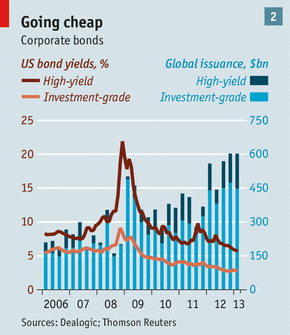

So the expectation of prolonged low real rates is, as policymakers hoped, edging investors down riskier paths. Corporate bonds were their first port of call. In 2012 investors poured $535.2 billion into bond mutual funds worldwide, the equivalent of 95% of all net inflows into mutual funds that year, according to Morningstar, a research firm. By contrast $124.7 billion flowed out of equity funds.

Clothing the naked

This demand for fixed-income investment has lowered borrowing costs for businesses. Standard & Poor’s, a rating agency, says that yields on low-rated, or junk, bonds in Europe halved from 12% to 6% in 2012. Companies with a junk-bond single-B rating are able to borrow at a rate that is four percentage points below the post-2000 average, according to Citigroup, a bank, whereas a typical investment-grade company, ranked A, can borrow at 2.4% compared with an historical norm of 5.1%.

As a result many multinationals can borrow money more cheaply than European governments. Procter & Gamble pays 2.3% on its ten-year bonds; Italy pays 4.6%. Large companies are filling their boots accordingly: global corporate-bond issuance topped $2 trillion in 2012, the highest level since 2009 (see chart 2).

Low rates have not just made life easier for some consumers and big companies by reducing their borrowing costs. They have also allowed firms to substitute debt for equity. This usually boosts earnings per share, which makes it an attractive choice for executives motivated by share options. American companies spent around $400 billion last year buying back their own shares, the equivalent of 2.6% of GDP. British ones spent 3.1% of GDP the same way. The trend has continued in 2013. By March 7th, $111.6 billion of American share buy-back programmes had been announced, a 96% increase on the same period in the previous year, according to Thomson Reuters.

Easy money also lets you buy other companies. In 2007 America saw $1.6 trillion in mergers and acquisitions, part of a world total of $4.6 trillion, according to Dealogic, a data provider. The world’s 2013 total for takeovers was just $2.7 trillion; in America the market has been bumping along at or below $1 trillion a year.

Now that may be changing. Dell, a personal-computer company, announced a management buy-out, only to face the prospect of competing bids from Blackstone, a private-equity group, and Carl Icahn, a well-known investor. American Airlines and US Airways have announced a merger. In February a consortium including Warren Buffett of Berkshire Hathaway and 3G, a Brazilian private-equity group, bid $28 billion for H.J. Heinz, a foods giant.

These high-profile takeovers and the strong level of buy-backs may be a sign of greater corporate confidence—particularly in America. But it could also be a sign that companies are finding it hard to increase profits organically by selling more goods, or improving margins. By end-March the S&P 500 was up by 11.4% on the previous year. But first-quarter profits were expected to be just 1.3% higher, according to Société Générale, an investment bank.

Another sign that growth may not be wholesome is the revival of the asset-backed security. When Americans borrow money to buy a car or a house, their debts are often repackaged as the backing for a bond. Before 2007 investors believed that such bonds were safe investments because large numbers of car buyers and homeowners were unlikely to default at once. But low—“subprime”—credit standards made default more likely. When the penny dropped, the prices of subprime securities plummeted.

So far this year $5.7 billion of subprime car loans have been issued, a 30% increase on last year. And there has also been a revival in the issuance of collateralised loan obligations (CLOs). These act like mutual funds, buying a portfolio of loans and then selling portions of the portfolio (tranches) to investors. The different tranches reflect the different risks; the riskiest portions bear the first loss if the loans default. In the first quarter of 2013 CLO issuance reached $27 billion, half the entire total for 2012—around the levels of 2007, and higher than many would have imagined in the days after the crisis, when CLO was a dirty word.

A further sign of an appetite for financial risk is the willingness of investors to buy loans with minimal protection in the case of a deterioration in the debtor’s financial position—so-called covenant-lite loans. More than half of loans sold to non-bank lenders in January were covenant-lite, the highest proportion ever, said Morgan Stanley, a bank. Leveraged loans (those made to highly indebted borrowers) have also bounced back; issuance in the first quarter of 2013 was a record $286.6 billion, according to Thomson Reuters.

The turn

Another product to regain popularity is the commercial mortgage-backed security. J.P. Morgan has raised its forecast for issuance this year to $70 billion, compared with $45 billion last year, citing high investor demand and confidence that the property market is recovering. Typically, property performs well when rental yields (currently around 5.8%) are high relative to the cost of finance.

It would be better if low rates encouraged companies to put their money to work by building new factories and employing more workers. Companies certainly have the cash. American firms are sitting on around $1.8 trillion, European ones some €1 trillion ($1.5 trillion).

In theory, low rates should persuade companies to boost investment. Businesses keep lists of projects they might want to finance based on their expected returns. Whether they proceed with the project will depend on how impressively the expected return exceeds the cost of financing them. The lower the cost of borrowing, the lower the hurdle a project’s rate of return has to surmount. In practice investment, as a proportion of GDP, is lower than it was before the crisis in America, Britain and the euro area (see chart 3).

In America there are some signs that, as with the housing market, a recovery is beginning. Non-residential fixed investment picked up sharply in the fourth quarter of 2012, after a fall in the third; for the year as a whole, investment increased by 8%, following an 8.6% rise in 2011.

The rules of the game

Business sentiment may still be feeling the effects of the confidence-sapping political shenanigans over America’s fiscal position. Lingering worries over the break-up of the euro zone don’t help. With the outlook for economic growth still cloudy, it is hardly surprising that companies will be cautious about rushing into investment plans. “If you announce a big investment plan at the moment, everybody will sxxx their teeth and talk about a brave decision,” says John Grout of the Association of Corporate Treasurers in Britain.

Companies have to worry about a lot of factors before approving a long-term project: the balance of supply and demand in their industry, the regulatory and political backdrop, the availability of skilled employees. “Interest rates are not a significant factor in our decision-making on investment because interest expense is only a small proportion of our cost base,” says Ulf Quellmann, global head of Treasury at Rio Tinto, a mining group. Hurdle rates for investment projects change slowly. Eric Elzvik, the chief financial officer of ABB, a Swiss engineering giant, says the group has not materially altered its hurdle rate over the past three to four years.

This is no surprise to people watching Japan, where nominal interest rates have been near zero for a decade (although real rates are positive) and the absolute level of investment is no higher, in real terms, than it was in 1997. “Corporations have been caught in too many cycles where they invested in anticipation of domestic growth that never happened,” says Richard Katz, who writes the Oriental Economistnewsletter. Businesses do not invest because the economy is weak; the economy stays weak because businesses do not invest. Hence Mr Kuroda’s attempt to shock the system.

One reason for the reluctance of multinationals to invest their cash may be precautionary. After Lehman Brothers collapsed in the autumn of 2008, the bank funding market dried up—a nasty shock for businesses. And unlike their bigger brethren, small and medium-sized companies cannot turn to the bond markets when banks keep their doors closed. In the euro area, bank loans to businesses fell by 0.4% in the year to February. In January only 1% of European banks said that their credit standard for loans to small businesses had eased, compared with 12% that said standards had been tightened.

Richard Raeburn of the European Association of Corporate Treasurers says that, for smaller companies, any benefit from low official rates has been almost totally offset by higher lending margins charged by banks. This complaint is loudest in Hungary, Spain, Poland and France.

Even where companies are increasing their capital expenditure, they may not be doing so at home. Emerging economies have grown faster than developed ones through the crisis and rich-world companies have shifted their investments accordingly. Standard & Poor’s calculates that European companies placed 42% of their investment outside the continent in 2012, compared with 28% in 2007.

And there are some areas where the effect of low rates is unambiguously negative. A final-salary pension is a promise to make a series of future payments, just like a bond. Accounting rules therefore use bond yields to value the future liability; lower bond yields increase the cost of the pension promise. A pension pot thus buys a much smaller income these days.

The result is that corporate pension funds are running fast just to stay in the same place. Despite a good year for stockmarkets in 2012, the final-salary pension funds of American companies in the S&P 1500 finished the year with their highest deficit ever: $557 billion. This despite contributing $60 billion to schemes during the year (up from $43 billion in 2008).

The old and the young

In Britain, the National Association of Pension Funds estimates that, by driving bond yields down, quantitative easing had by 2012 increased pension deficits by £90 billion. The strain on corporate finances caused private-sector final-salary pension schemes to close at a record rate last year.

Insurance companies face a similar issue. The return they get from investing money taken in as premiums before it is paid out as claims is a crucial part of their income. Tidjane Thiam, chief executive of Prudential, a British life insurer, says that long-term bond yields of just 2% are scant reward for investors; the company has changed its business model to focus more on income from underwriting and from managing money for third parties. Colin Simpson, an insurance analyst at Goldman Sachs, points out that general insurance companies have been lucky; the period of low rates has coincided with the absence of claims on the scale of those generated by Hurricane Katrina in 2005. Such luck can turn.

Despite the problems for some sectors, and the inability, so far, of low rates to make life better for small and medium-sized companies, it seems highly unlikely that any of the big rich-world central banks will tighten monetary policy in the near future. The risk of sending the economy back into recession is too great. The way in which investors and the corporate sector take advantage of those low rates will set the tone for the developed economy in the next few years. There may not be blood but there will almost certainly be bubbles.

Source: Economist 6th April 2013