PROJECT DETAILS

The Urban and Development Board (URA) has sold a mixed development site in Lentor Central, about 3 minutes walk to upcoming Lentor MRT Station, as part of Government Land Sales (GLS), in 3rd quarter of 2021.

GuocoLand won the top bid of S$784 million and this translates into S$1,204 per square feet per plot ratio.

This land parcel located in Northern Region of Singapore, near Florissa Park, Lentor Drive and Yio Chu Kang Road, It is nestled around the boundaries of Ang Mo Kio, Thomson, Yishun, Sin Ming, Central Water Catchment and Bishan.

It has a site area of 185,139 square feet and is allocated to be developed into a mixed development with approximately 610 residential apartments with 86,100 square feet of commercial.

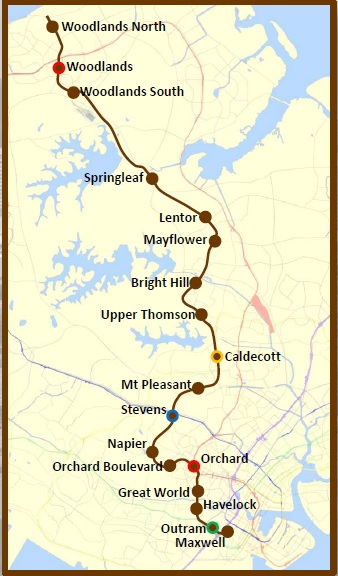

New Condo at Lentor Central will be seamlessly integrated with the Lentor MRT Station, serving the Thomson-EastCoast Line (TEL) and is scheduled to begin operations on 28th August 2021. When TEL is completed around 2025, residents will have convenient access to many parts of Singapore, from Bikit Timah, Botanic Gardens, Orchard Road to Marina Bay and East Coast. In addition, residents will be able to connect to all parts of the major lines- Circle Line, Downtown Line, North-East Line, North-South Line and East-West Line, all via TEL. Both the residential and retail components of the upcoming deelopment will be able to tap into a huge and affluent catchment.

It is surrounded by greenery parks and cycling paths towards new Lentor MRT and the Teachers' Estate.

Other condominiums in the vicinity include Thomson Grove, The Calrose, Far Horizon Garden and Season Park.

For Pleasure of Ownership,

Please Register HERE and

we will contact you soonest!

as a first property important?

S$1 million property?

passive income

|

Project |

Lentor Central Condo with commercial units |

| Developer | GuocoLand |

| Location | Lentor Central (Under Ang Mo Kio Planning Area) |

| District | 20 |

| Tenure | 99 years leasehold |

| Site Area | 17,200 square metres/ 185,139 square feet |

| GFA: | |

| Plot Ratio | 3.5 |

| Expected TOP: | |

| Total Units | Approximately 610 residential apartments |

| Total Carpark | |

| Development | Private Condominium comprising of full communal facilities |

| Unit Type: | |

| Architect | |

| Eligibility | SC, SPR and foreigner can buy (No Restriction) |

LOCATION MAP and AMENITIES

New and Upcoming Condo in Lentor Central is standing near to new Lentor MRT station, along the Thomson-East-Coast Line. A less than a 5 minutes walk distance to the Lentor MRT Station adds convenience and efficiency to the residents of the Condo in Lentor Central.

SITE PLAN and FLOOR PLANS E-BROCHURE

The Facilities and Site plan of new Condo launch at Lentor Central, are currently seeking approval from relevant authorities.

If you would like to be updated on first hand information for New Condo at Lentor Central, Please

Register with Us

for More information!

NEW CONNECTIVITY- NORTH-SOUTH CORRIDOR TO BE READY IN 2026

North-South corridor, when completed in 2026, will ease traffic from the North into the City and vise versa, especially on the Central Expressway (CTE) and roads like Thomson Road and Marymount Road, cutting travelling time for drivers.

It will offer better connectivity to towns like Woodlands, Sembawang, Yishun, Ang Mo Kio, Bishan and Toa Payoh. Dedicated bus lanes will have 10 to 15 minutes off bus rides to and from the city. And cycling trunk routes will also be build to the city centre.

NEW MRT CONNECTIVITY- THOMSON EAST COAST LINE

Thomson Line- More options of accessibility with lesser time travelled

Thomson Line Stages of opening

Stage 1- January 2019 to December 2019

Thomson Line TSL will be completed in 3 stages. The first stage will have 3 stations, Woodlands North MRT Station, Woodlands MRT Station and Woodlands South MRT Station.

Stage 2: January 1 2020 to December 31 2020

The second stage, which will be completed by 2020, will have 6 stations, stretching from Springleaf MRT Station to Caldecott MRT Station.

Stage 3: January 1 2021 to December 31 2021

The last stage of Thomson Line TSL which is due to be completed by 2021, stretching from Mount Pleasant MRT Station to Gardens by the Bay MRT Station, Thomson Line TSL will serve 400,000 commuters daily.

Together with North South Expressway, connectivity wil expand manifold.

SINGAPORE PROPERTY MARKET

Singapore’s property market has one of the best long term returns on equity performance out of most investment instruments available.

And that has to do largely with the strength of the Singapore dollar, the availability of high leverage, and the attraction of Singapore to the international audience, not just as a region to invest in, but as an asset class on its own.

CHECKLIST REQUIREMENTS

Before you embark on searching for your investment property, it is important to have gone through this checklist below.

1. Finances

We will advise about your finances to understand the initial cash/Central Provident Fund (CPF) outlay required.

Having an experienced third party do an assessment would help you prevent costly beginner mistakes that could seriously hamper your journey to financial freedom.

We will help you assess the minimum cash and CPF required for the down payment, buyer stamp duties, legal fees and miscellaneous costs, as well as advise you on an investment road map for the best acquisition strategy as you progress along and acquire more properties.

2. Loan eligibility

The current Total Debt Servicing Ratio (TDSR) framework makes it especially important for investors to check on their maximum loan eligibility so that there are no nasty surprises after placing a deposit.

In this case, this should be one of your priorities early on and we will assist you on this.

3. Manner of holding

For investors who already own an HDB flat or private home and are acquiring their second property, we will advise you on the various options available to optimise tax savings (which can be significant) and qualify you for more funding options.

This is especially important for those who intend to grow their portfolio of properties and would require access to higher leverage and lower costs.

4. Investment goal and horizon

Having a clear idea of your investment goal horizon helps you narrow down the segments you should focus on; saving you precious time and energy.

Examples

– Are you investing in properties to provide a consistent source of passive income?

In this case, focus on areas with low vacancy rates and a high tenant catchment pool.

– Are you investing in properties short term to ride the market trend?

In this case, are you financially prepared to hold on in case a black swan event occurs?

– Are you investing in properties with en bloc potential?

In this case, are you well advised on which properties have genuine potential?

Not all old properties have en bloc-ability.

After going through the above points, the following are factors that have served me and my clients well in the past as an investment criteria checklist.

GUOCOLAND WON TOP BID FOR CONDO SITE AT LENTOR CENTRAL

RESIDENTIAL land prices continue to rise, reflecting developers' optimistic outlook on private home prices and continuing hunger for land, going by the latest state land tender closings.

GuocoLand emerged as the highest bidder for a plot next to the upcoming Lentor MRT station on the Thomson-East Coast Line (TEL); the site is designated for private housing development with commercial space at first storey. GuocoLand's bid of S$784.1 million, or S$1,204 per square foot per plot ratio (psf ppr) surpassed the expectations of property consultants polled by BT before the tender close.

The tender for the other plot that also closed the same day, for an executive condominium or EC site in Tampines Street 62, saw a fresh record price for EC land, toppling the S$603 psf ppr set in May for a plot in Tengah Garden Walk.

In the latest tender, the top bid for the Tampines plot was S$422 million or S$659 psf ppr, exceeding the forecasts of most property consultants. The highest bid was placed by a consortium comprising a Qingjian Realty and Octava Pte Ltd joint venture, and Santarli Realty. The top bid was 1.4 per cent higher than the second highest offer, from Intrepid Investments and TID Residential, of S$650 psf ppr. ECs are a public-private housing hybrid.

The tenders for both plots drew nine bids each.

JLL senior director of research and consultancy, Ong Teck Hui, said: "The recent return to Phase 2 (Heightened Alert) has not dampened demand for sites, as it is probably seen as a short-term event while current tender sites could be launched for sale a year or more later amid positive market conditions.

"The keen tender participation and optimistic top bids are indicative of strong demand for residential sites by developers to replenish their land banks."

In similar vein, PropNex CEO Ismail Gafoor said: "The resilient home prices and healthy buying demand also demonstrate the strength of the housing market, and this has in turn boosted developers' confidence."

For the Lentor Central plot, the top bid by GuocoLand - part of Malaysian tycoon Quek Leng Chan's Hong Leong Group of Malaysia - was 4.5 per cent higher than the second highest bid of S$1,152 psf ppr, from a tie-up comprising Intrepid Investments, Hong Realty and TID Residential; the trio are part of the Hong Leong Group Singapore, helmed by Mr Quek's Singaporean cousin Kwek Leng Beng.

Interestingly, the third highest bid, at S$1,131 psf ppr, was from a tie-up between City Developments Ltd (CDL) and Hongkong Land unit MCL Land. CDL is the SGX-listed property and hotel arm of Hong Leong Group Singapore.

CBRE's head of research for Southeast Asia, Tricia Song, noted that the top three bids for the Lentor plot surpassed the S$1,118 psf ppr winning bid for the private housing plot in Ang Mo Kio Avenue 1 at the May state tender, reflecting "consensus confidence in the Lentor site due to its proximity to a MRT station, an absence of new supply in the area, and its location in a serene low-rise estate".

That said, Lam Chern Woon, head of research and consulting at Edmund Tie & Co, highlighted that the nine bids received for the Lentor plot is fewer than the 15 bids for the Ang Mo Kio Avenue 1 site in May. This, he says, "reflects cautiousness among developers due to the ongoing uncertainties within the construction sector". Moreover, the high absolute price quantum for the Lentor plot vis-a-vis the S$381.4 million top bid for the Ang Mo Kio site, could have deterred smaller developers. The maximum gross floor area (GFA) for the Ang Mo Kio site is about half that of the Lentor plot.

GuocoLand's proposed scheme for the Lentor Central plot envisions a mixed-use, transit-oriented development of 25 storeys with around 600 residences with the convenience of having a substantial amount of F&B and retail space, including a supermarket and more than 10,000 sq ft of childcare facilities. "Located in the Thomson area that has mostly landed homes, residents will also enjoy unblocked views of the surrounding areas. Living there also means having vast amount of nature reserves and parks in proximity," said GuocoLand's spokesperson.

The plot is also close to established schools such as Presbyterian High School, Anderson Primary School, and CHIJ St Nicholas Girls' School.

CONTACT US

You are only one-step away from owning a unit in New Condo in Lentor Central

Thank you for Your interest in New Condo in Lentor Central

Be among the first to view and book New Condo in Lentor Central, a new life-style living condominium in Sembawang, at the lowest pre-launch price

Enjoy attractive prices before the official public launch. Be the first to secure your choice unit

- Latest updates on the development

- Priority unit choice and selection

- Enjoy early-bird VVIP Discounts

- Direct Developer price

- No Commission payable

Register for a copy of New Condo in Lentor Central, Floor plans, E-Brochure, Pricing and Latest Updates when available!