Property Launches & Investments

This is some blog description about this site

How long will the Singapore private property market malaise last?

- Font size: Larger Smaller

- Hits: 1429

- 0 Comments

- Subscribe to this entry

- Bookmark

For those who missed the recent URA private property price index flash estimates, the index has dropped again in 2014Q3 . For many casual observers, the drop in the private property market has stopped becoming news as many have gotten used to the “new normal” – a lacklustre property market.

By now, the question on stakeholders’ minds has changed from “when the property market will peak” to “how long the Singapore property market malaise will last”. That is the million-dollar question that many consultants are still trying to figure out. To give readers some sense on how bad past markets have gotten, here are some data on how the property market had performed in the past few slowdowns.

How long did the longest property market downtrend last?

The private property market peaked in 2013Q3 at 216.3points. Since then, the price index has been on a downward trend for the last 4 quarters. To those who have heavily invested in the private residential market and bought multiple properties, the last 12 months must have seemed like a very long time.

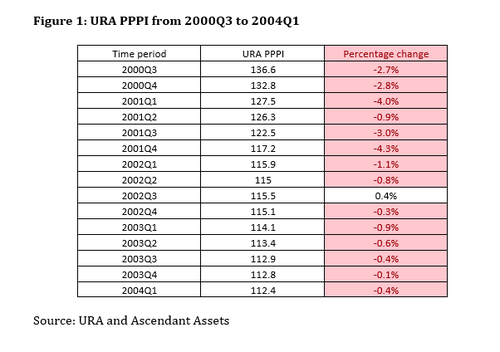

However, have you wondered how long the longest stretch of market down turn lasted? Based on the historic URA PPPI, the longest market down trend lasted for up to 15 consecutive quarters (or about 45 months!). Based on Figure 1, the downtrend lasted from 2000Q3 to 2004Q1 with a single quarter of reprieve in 2002Q3.

The main reason for this extended period of contraction was due to the “perfect storm” of the dot-com crash in 2000, World Trade Centre terrorist attack in 2001 and SARS in 2003. It was only after the Ministry of National Development introduced measures that facilitated easier property purchases did the market turn around.

Those who were in the real estate market then would remember the deferred payment scheme, and how it was possible for buyers to purchase multiple properties without paying additional stamp duties and they could get loans for as much as 90% of the purchase price.

What is the duration of the next longest market downtrend?

Some readers may feel that it is too extreme to compare against the longest down trend and wonder what is the duration of the next longest downtrend. Based on the URA PPPI, there were 2 stretches of downtrend that lasted for 10 quarters, which works out to be 30 months. From Figure 2, it could be seen that one of the downtrends lasted from 1984Q1 to 1986Q2 and the other lasted from 1996Q3 to 1998Q4.

I must qualify by saying that I am fully aware that historical performance is not representative of future results. Some may also cite that the property downturn during the 2008 Global Financial Crisis only lasted for 4 quarters; hence it would be inaccurate to deduce the duration of the current market malaise based on how the market did in the past.

That said, the current market is not really a result of market forces but mainly due to government intervention. Essentially, the property market is something most governments will closely monitor, as it directly impacts the citizenry. Hence the real question is how long the government will wait before they step in to lift any measures.

Looking at how the government has responded in the past, they will take action to alleviate any negative market condition under 2 conditions. First is if the price drop is too drastic. Second is if negative sentiments persist for an excessively long period of time. In other words, looking at some of the past trends, barring any sudden drop in the real estate prices, it seems that the government has the appetite to wait for 10 to 15 quarters before taking action.

Conclusion

In conclusion, managing the property market is not an enviable task, as it is not easy for regulators to manage the needs of the myriad of stakeholders. If too much control is imposed and prices fall, property buyers will be happy, but many existing owners and property developers would be adversely affected. Conversely, if the government adopts a laissez-faire approach, while property owners will be happy, those who are looking to upgrade would find it hard to realise the elusive dream of owning a private property.

This article is not meant to be a market forecast. Taken in the correct context, this piece intends to give readers some sense of how long past market malaise had lasted before, and how long it can potentially last this time. Ultimately, those who are hoping that the government would quickly step in to reverse the trend could be in for a long wait ahead.

Source: Getty Goh 8th Oct 2014