Property Launches & Investments

This is some blog description about this site

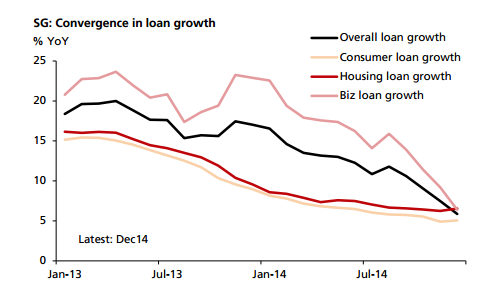

Chart of the Day: Singapore's loan growth abruptly tumbles to multi year low

- Font size: Larger Smaller

- Hits: 1032

- 0 Comments

- Subscribe to this entry

- Bookmark

Amid a weak economic environment.

Three months ago, loan growth was still hovering at double-digit level.

Headline loan growth for December moderated to 5.9% in the month, the slowest since Mar10.

The pace of the decline seems abrupt to some as just about three months ago, loan growth was still at double-digit level.

According to DBS, an uncertain global outlook and sluggish growth momentum in 2H14 juxtaposed with rise of higher interest rates have probably contributed to the weakness.

Loan growth to businesses fell further to 6.4%, from 9.2% previously. Loans to the manufacturing sector dipped into the red, contracting by 6.3%, as the sector continues to struggle with cyclical weakness and structural hollow-out. Loans to the petroleum-related cluster also moderated sharply to 27.3%, from 63.3% in November. A plunge in oil prices and cutback in capex spending is probably the main reason for the easing.

Here’s more from DBS:

However, consumer leverage has picked up. Consumer loan growth rose marginally to 5.1% YoY compared to 4.9% previously. This is mainly driven by the acceleration in housing loans, probably on account of more new launches in residential projects as well as consumers front-loading their purchase to capitalise on the relatively lower interest rates before the anticipated rise in funding costs going forward. Plainly, this suggests the existence of pent-up demand on the side-lines to capitalise on a gradually cooling real estate market.

Going forward, overall loan growth is expected to continue to moderate against the backdrop of higher interest rate expectation. In this regards, the 3mth SIBOR has spiked up recently in conjunction with a weakening in the SGD. If such trend persists, loan growth will definitely be pressured further.